Approach

We target industries positioned to benefit from long-term drivers (income, aging, health/wellness, and convenience) and companies with a clear potential to extract synergies by executing M&As (by leveraging brand, distribution, and/or reducing SG&A). This focus enables our investments to have health organic/inorganic growth paths as well as potential to exit at a premium valuation to strategic players.

Additionally, by having clear-cut targeted industries, we can develop a thorough understanding about each of them and have a value-added approach with entrepreneurs since the first interaction, creating a differentiated angle when proposing a partnership.

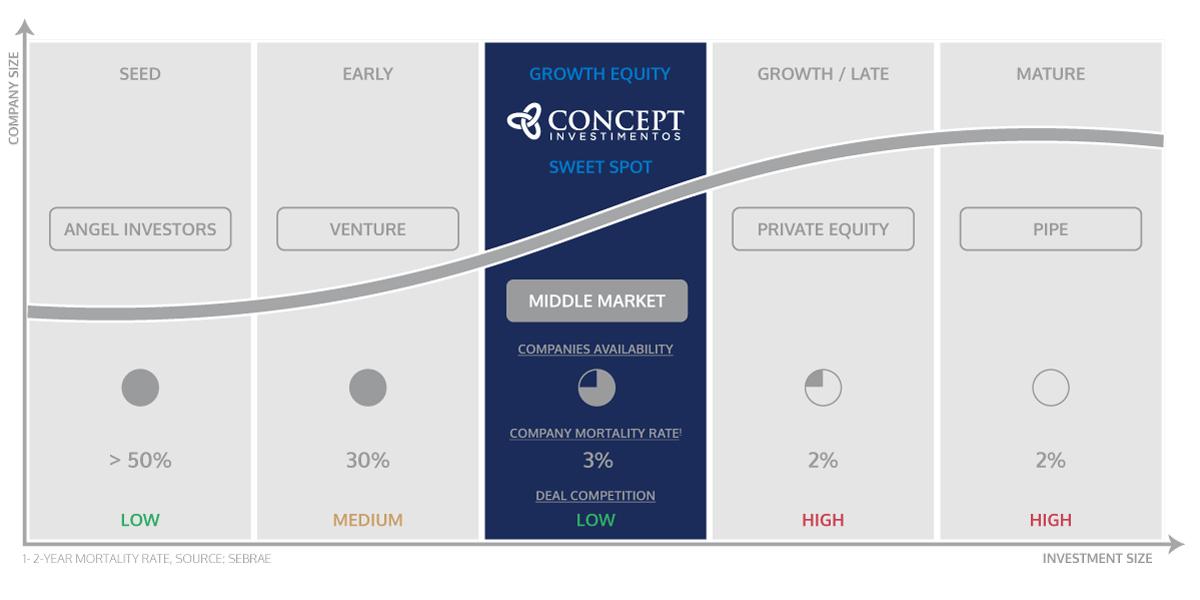

Finally, our focus on middle market allows us to combine (i) vast amount of high-growth / profitable companies with (ii) proven business models with a low mortality rate and (iii) a shift from price-based negotiation to a value-added/collaborative approach when partnering with entrepreneus.

Criteria

Combination of top-down, long term drivers – Income, aging, health/wellness, and convenience – with Concept’s team track record.

- Branded foods & ingredients

- Human health

- Animal health

- Cosmetics

- Business services

- Technology

- R$ 8+ million in EBITDA

- Potential to unlock value by upgrading management, improving capital structure, accelerating organic expansion, and empowering consolidation

- Clear exit to strategic players at a premium valuation

- Passionate management team and entrepreneurs, with significant market knowledge

- Entrepreneur values Concepts’s role

- Brazil

- Growth equity

- Consolidation

- Management/owner buyout

- Sponsor-to-sponsor

- R$ 50+ million in equity investment

- Shared control and governance

- Entrepreneur is a relevant shareholder and the Company represents a significant portion of his/her net assets

- Potential to 4x – 5x MOIC

- Exogenous, binary, and regulatory risk

- Greenfield, distressed assets or start-ups

- Excessive governmental exposure